FV Function: Comprehending FV Function and 10 Different Examples

FV Parameters

The function has different arguments that keep its efficiency at high performance. These are rate, nper, pmt, PV and type.

Rate: This is essential to the function, and the interest rate has to be on every period.

Nper: This is critical to FV function, and is considered to be the quantity of times within a period of a year.

Pmt: This is another part of the function that must be included. It is a payment made every period, and it cannot be changed over a year. It is typical for the pmt to include principal and interest, but other fees or taxes cannot be included. If the pmt is omitted, then it is essential that a PV argument is included.

PV: This is an optional parameter of the FV function. It is known as either the present value or a lump-sum amount that the future payments currently worth. If it happens that the PV is omitted, then it would be assumed to be 0, which means it is necessary to include a pmt argument.

Type: This has been understood to be optional, and therefore using it is only dependent on the choice of the user. There are two numbers; 0 and 1, and they respectively indicate when all payments are due. If it happens that the type has been omitted, then it would be assumed to be 0.

Is the Investment Beneficial?

There is a possibility of having a new business branch, and we want to know if it would be a beneficial decision. We have made an assessments for the current business, and we believe that we might be capable of having a new branch. The business is considering taking a loan from the bank, and want to know how much the bank would get after the loan period has passed. This evaluation is the main source of making the right decision. This is where the FV function is useful.

=FV(B4/12,B5,B6)

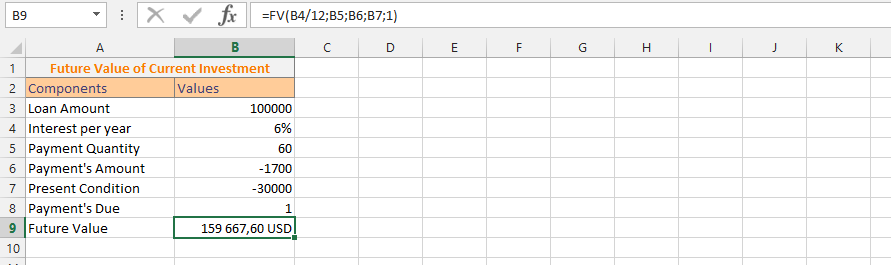

Knowing Value of Current Investment

in the Future This example fully use the FV formula, which differentiates it from previous example. We received a new proposal, we have already acknowledged that the current condition is already in negative value, and we are trying to know if the investment would return with appropriate benefit in the future. The example illustrates how much we think that the proposal would worth five years from now. It would provide us the possibilities of making further assessments that would ultimately lead to a decision.

=FV(B4/12,B5,B6,B7,1)

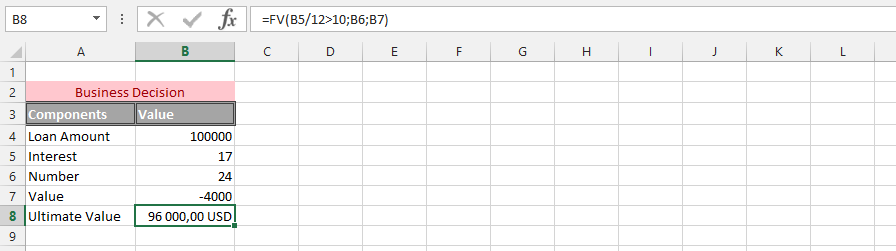

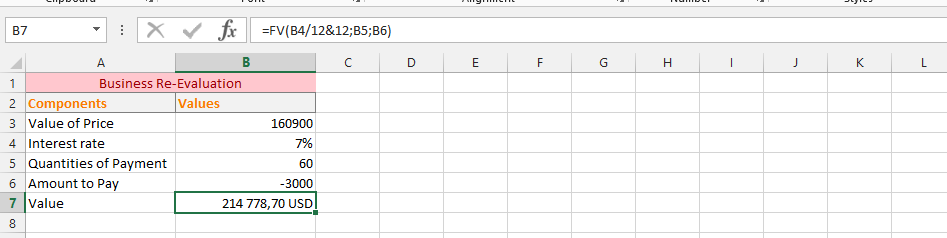

Using FV Function to Make Business Decision

We are currently considering the right business’ assessment for us. There is a company that owns us money, and we have different possibilities of extending that loan. As an investing company, it is necessary for the business to have a solid decision ready, because the company wants to extend its loan with additional two years. There are some details that we have excluded from the official information, and the only thing we could do is make a new evaluation of the current loan. We’d just want to evaluate the rate itself.

=FV(B5/12>10,B6,B7)

Deciding Value if Payment Increase by Additional 12%

We have a small problem, the global economic crisis have impacted our business. We would like to know how we could raise the amount of money required to meet up with the economic fiasco that has occurred. It has been a tough few years, and the company has experienced financial losses, and we would now like to be able to have our customers help us with coping with the current financial situation. For that reason, we asked ourselves a simple question, what happened if we increase the value of payment with 12%? We’d know it might not affect our customers much, because 12% increment of the current payment value might not be too much for the customers to pay.

=FV(B4/12,B5,B6&0,12)

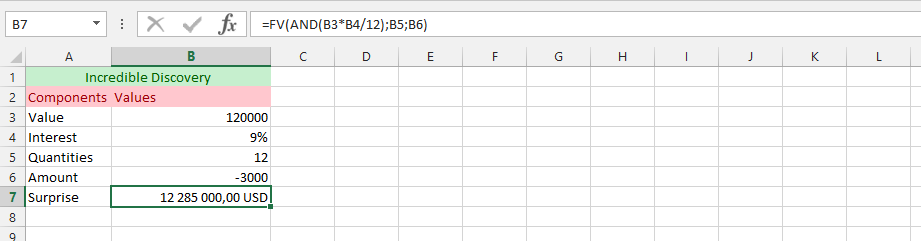

An Incredible Discovery with FV & AND Functions

There is a small issue that we would like to evaluate how we could find answers to it, and we’d have a current value of the loan, which makes it necessary for us to try and find the appropriate details. We are trying to find out how the current value has effect on the overall value. This is where both the FV & AND formulas would be useful.

=FV(AND(B3*B4/12),B5,B6)

Doubling the Interest Rate

In this example, we are considering the possibilities of doubling the interest rate without the possibilities of acknowledging the loan taker, and we would like to inform that this interest rate increment is due to the financial global crisis that have impact on the business condition.

=FV(B4/12&12,B5,B6)

Evaluating with Text

There is a simple understanding of the way that market looks like, and for that reason we have been looking into checking about a whole new value for a deal that is already steady at a specific amount. We’d know the right way to make the business deal, and the only thing that the customer knows is how much they are being learnt for a specific amount to pay on a monthly basis, and it would be an unofficial evaluation for overall of the business deal.

=FV(rate/12,quantity,amount)

Using FV and OR Functions in Flexible Rate

This example is about looking into the business’ deal, and we know that the current value of the deal needs to escalate to a flexible kind. We’d have a phone call from the client, who has asked that the deal would only be extended for six months, and it should be possible, so we decided to use both the FV and OR functions to make the final decision about the value.

=FV(OR(rates),quantity,amount)

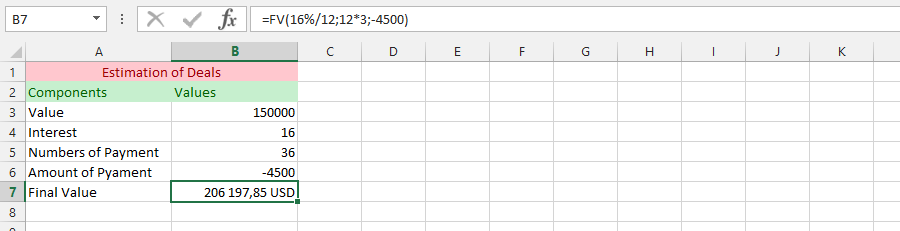

FV with Just Numbers

In this example, we are making different estimations about the business, and we wouldn’t know what is more beneficial. For this reason, we are using the FV function with solely numbers. We are making some kind of different speculations to estimate, so we could make a profitable deal in the long run. This example is to verify that it is possible to use the FV without laying out any data.

=FV(16%/12,12*3,-4500)

Using FV on another Spreadsheet

In this example, we have our data on a different sheet, but we would like to check on a different spreadsheet, just so we would verify that the data is accurate. For this reason, we have outlay the data on another, and we would want to have the value on a different sheet.

=FV(Sheet1!B4/12,Sheet1!B5,Sheet1!B6)